This page outlines the mining process and emission schedule for Salvium (SAL), highlighting how it differs from its predecessor, Monero, and explaining the rationale behind these changes.

Mining in Salvium

Salvium uses a Proof of Work (PoW) consensus mechanism, similar to Monero. Miners contribute computational power to secure the network and process transactions, and in return, they receive newly minted SAL tokens as rewards.

Key Mining Features:

Tail Emissions

Like Monero, Salvium implements a tail emission to ensure long-term mining incentives and maintain network security.

Tail Emission Details:

Tail Emissions

Like Monero, Salvium implements a tail emission to ensure long-term mining incentives and maintain network security.

Tail Emission Details:

- Algorithm: RandomX (inherited from Monero)

- Block Time: 120 seconds (same as Monero)

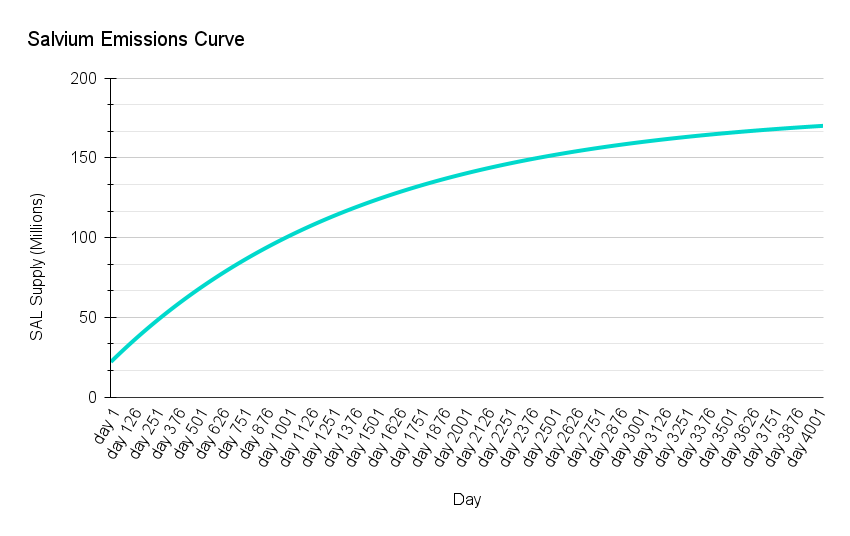

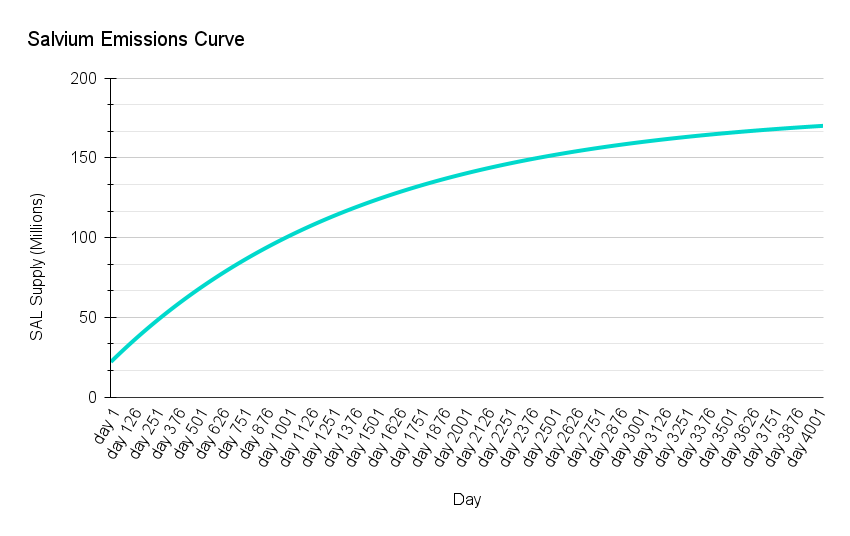

- Increased Block Emission: The emission per block has been increased fivefold compared to Monero.

- Extended Initial Supply Duration: The duration for reaching the initial supply has been doubled.

- Initial Supply: 184.4 million SAL

- Emission Curve: Flatter and wider compared to Monero

- Greater Liquidity: A larger initial supply helps improve market liquidity.

- Wider Distribution: Extended emission duration allows more participants to acquire SAL through mining.

- Balanced Incentives: The modified schedule aims to maintain strong mining incentives over a longer period.

Tail Emissions

Like Monero, Salvium implements a tail emission to ensure long-term mining incentives and maintain network security.

Tail Emission Details:

Tail Emissions

Like Monero, Salvium implements a tail emission to ensure long-term mining incentives and maintain network security.

Tail Emission Details:

- Activation: Once the maximum supply is reached

- Rate: 3 SAL per block

- Sustainable Mining Incentives: Ensures miners continue to secure the network even after the initial supply is mined.

- Long-term Network Security: Provides ongoing rewards to maintain a robust mining community.

- Inflation Control: Introduces a predictable, low rate of inflation to counteract lost coins and maintain economic activity.

- Initial Phase: 80% to miners, 20% to stakers

- Future Phase: 100% to miners (once DeFi features are operational, stakers will receive a share of system fees)

- Miners can expect consistent rewards even in the long term, encouraging sustained participation.

- Users benefit from a secure network with a predictable, controlled inflation rate.

- The larger initial supply and extended emission duration may lead to different price dynamics compared to more scarce cryptocurrencies.