In the early days of cryptocurrency, the cypherpunk movement envisioned a financial revolution. They believed that crypto would not just challenge, but entirely replace traditional finance. This ideology was rooted in principles of privacy, decentralization, and freedom from governmental control. As we look at the landscape today, however, we see a different narrative unfolding—one where integration with traditional finance seems to be the key to crypto’s widespread adoption and success.

The Conceptual Shift in Crypto Privacy

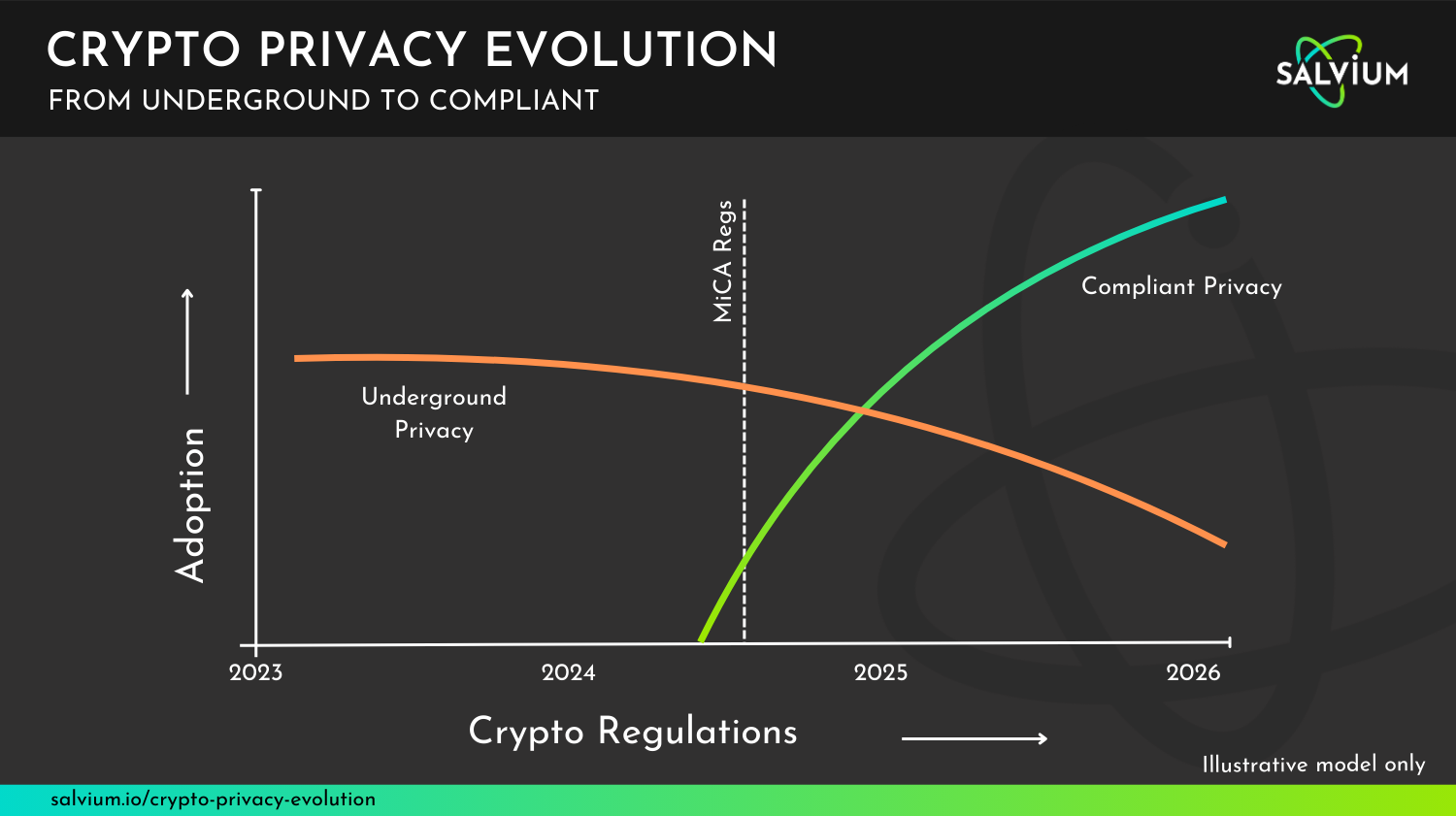

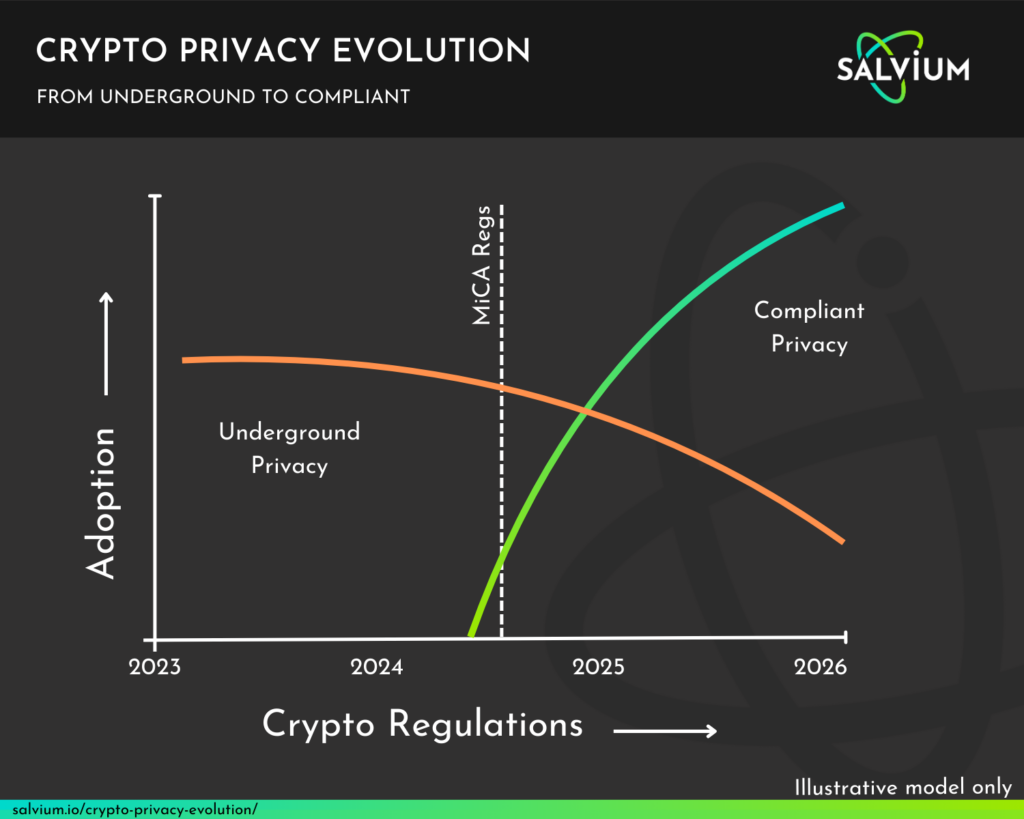

The above chart offers a thought-provoking model of how the landscape of privacy in cryptocurrency is likely to evolve. It proposes a scenario where the prevalence of “underground” privacy solutions in crypto could decline, while “compliant” privacy solutions see a significant rise.

This model, while not based on concrete data, serves to visualize an important concept: the potential trajectory of privacy solutions in the face of increasing regulation. It encourages us to consider how the crypto space might adapt to maintain privacy while achieving wider acceptance and adoption.

The Critical Role of Privacy

As crypto moves towards mainstream adoption, privacy remains a critical concern. Just as GDPR and other privacy laws have become fundamental in traditional finance and tech sectors, it’s reasonable to assume that similar standards will be expected—and possibly even required—in the crypto space.

This is where the concept of “compliant privacy” comes into play. It’s a seemingly paradoxical term that bridges the gap between the original cypherpunk ideals and the realities of operating in a regulated financial ecosystem. Compliant privacy aims to protect user data and transaction details while still adhering to necessary regulatory requirements.

A Tribute to Privacy Coins

It’s important to acknowledge the pivotal role that privacy-focused cryptocurrencies have played in the evolution of the crypto ecosystem. Coins like Monero, Zcash, and others have pushed the boundaries of what’s possible in terms of financial privacy. They’ve developed innovative technologies like zero-knowledge proofs, ring signatures, and stealth addresses that have advanced the entire field of cryptography.

These projects embody the original cypherpunk spirit and have been instrumental in bringing cryptocurrency to where it is today. They’ve challenged our assumptions about the nature of money and privacy in the digital age.

The Realistic Future of Privacy Coins

This concept invites us to consider a future for privacy in cryptocurrency that might diverge from early cypherpunk visions. While not predictive, this conceptual framework helps us explore the potential implications of increased regulation on privacy-focused cryptocurrencies. While the dream of crypto completely replacing traditional finance isn’t dead, it’s a long-term vision that faces significant hurdles.

In the near term, the path to wider adoption and legitimacy seems to run through regulatory compliance. This doesn’t mean abandoning privacy—far from it. Instead, it means developing privacy solutions that work within regulatory frameworks wherever possible.

This approach recognizes several realities:

- Governments and traditional financial institutions aren’t going away anytime soon.

- For crypto to achieve mainstream adoption, concerns about illicit use need to be addressed.

- Many users want privacy but also want the security of knowing their assets are legally recognized and protected.

The Salvium Vision

Salvium can see the future for compliant privacy. Whilst “underground” privacy solutions may continue to exist, the real growth and adoption will come from privacy solutions that can operate within regulatory frameworks – alongside mainstream projects and businesses.

This doesn’t mean complete transparency or abandoning the principles of user privacy. Rather, it involves developing technologies that can protect user privacy while still allowing for necessary compliance measures. This could involve solutions like:

- Selective disclosure mechanisms allow users to reveal only the minimum necessary information for compliance purposes.

- Privacy-preserving auditing techniques that can verify regulatory compliance without exposing individual user data.

- Decentralized identity solutions that allow for KYC/AML compliance without centralized data storage.

Conclusion

The path forward for privacy in cryptocurrency is complex and multifaceted. While we honor and appreciate the groundbreaking work done by early privacy coins, the reality of increasing regulation cannot be ignored. The future likely belongs to those who can innovate within these new parameters—creating robust privacy protections that also satisfy regulatory requirements.

This evolution doesn’t represent a betrayal of crypto’s roots, but rather an adaptation to ensure its continued growth and relevance. By working within regulations wherever possible, privacy-focused projects can bring the benefits of cryptocurrency to a wider audience, potentially influencing the development of those regulations in the process.

The cypherpunk dream of financial privacy and freedom isn’t dead—it’s evolving. And in this new phase, compliant privacy solutions may be the key to unlocking cryptocurrency’s full potential.